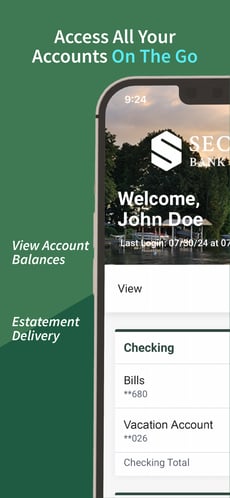

Mobile & Online Banking

Secure access to your accounts, 24 hours a day, 7 days a week.

Secure, convenient access to your accounts.

Internet banking gives you the convenience and flexibility to manage your finances any time day or night in a secure environment.

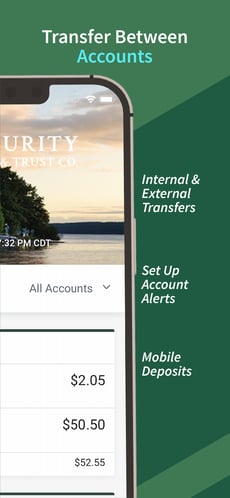

With Mobile & Internet Banking, you can:

- Make mobile deposits on your mobile device.

- Sign up for the convenience of electronic statement delivery! Eliminate unwanted paper and give yourself the security of instant access of your statements. (click for How To Video)

- View your account balances and detailed transaction history.

- Transfer money between accounts.

- View your check images.

- Save time and money paying bills online.

- Manage your debit cards, online, anytime.

Pay your bills online and save yourself the hassle.

Discover the ease and convenience of paying bills over the Internet. Cut down on the amount of paper in your life, and save time and money from writing checks, stuffing envelopes and buying stamps. And funds are not withdrawn from your account until the payment due date!

With the Online Bill services you can:

- Send payments to anyone in the United States – large businesses, such as your phone company, small businesses, or a friend – anyone you would normally pay by a paper check.

- Set up recurring, occasional, or one-time payments. With just a few clicks, you can schedule a payment to pay at a future date, or you can schedule a recurring payment – an auto or insurance payment for example – to be paid on the same day for the same amount every month and never have to worry about it again!

- Receive bills electronically from leading merchants.

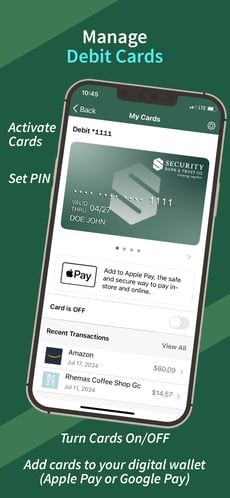

Manage your debit card online with My Cards

My Cards is an online tool that allows you to find, manage, use, and view your debit cards all in one convenient, secure location.

- Setup custom card controls & card transaction alerts.

- Activate cards, set PIN, and turn cards on/off.

- Report lost or stolen cards.

- Easily and securely add your cards to your digital wallet. (Apple Pay or Google Pay)

- Manage travel plans to keep your card secure and open while traveling.

Secure access to your accounts, 24 hours a day, 7 days a week.

When it comes to your money, security is the number one issue. With high-end firewalls and exclusive encryption software, it’s like having a bank vault available anytime, anywhere!

Download our Mobile App & Sign up for Internet Banking and Bill Payment today!

If you already have an account with us enroll now.

Download our Mobile App:

- Apple App Store

- Google Play Store

- If you’re not an account holder already, contact us to open up an account today!

Sign up for Text Banking for a Quick Look at Balances & History

Text banking can be signed up for through our online banking system to give you quick access to your balances and history. It’s particularly useful when you are on the run. To sign up today, please see the following text enrollment instructions.

Mobile Banking FAQs

General Questions

-

Mobile Check deposit is a service that allows a customer to submit a check to SBTC for deposit via their smartphone or tablet device. This is done by capturing an image of the front and back of the check (via the camera on the device) to be deposited and then submitting the image to SBTC via the device app.

-

Mobile check deposit is integrated into the new SBTC Mobile app and can be found under the DEPOSIT tab.

-

Yes. The customer must download the SBTC Mobile app to a camera-enabled Apple iOS or Android device. Mobile check deposit is not available via a computer or non-Apple iOS/Android device.

-

Most customers will. The only prerequisite currently in place to qualify for this service requires customer to have an eligible account type (Checking, Savings, MM, HSA). These requirements can change at the sole discretion of SBTC. Customers who abuse this service may be excluded from eligibility.

-

Yes. In order to maintain prudent risk standards, limits and hold rules apply and are at the sole discretion of SBTC. The current daily dollar limit is $5,000.00 per business day for qualified users. There is no limit on the number of daily items. Daily and monthly deposit limits may vary for qualified users. Such limits will be reviewed and adjusted periodically at SBTC’s discretion or upon their request. The customer can contact us with questions about the deposit limits and/or to request a review of their deposit limits.

-

No. This service is available to our customers free of charge; however, we reserve the right to change that at any time.

-

Mobile check deposit will be available to customers as soon as they download the SBTC Mobile app; however customers who abuse this service may be excluded from eligibility.

-

Yes. SBTC reserves the right to remove or change the functionality at any time. SBTC will periodically review accounts enrolled in mobile check deposit to ensure they are maintaining all eligibility requirements.

Questions About Using the Service

-

Once logged into the mobile app, select the DEPOSIT tab along the bottom.

-

Yes. The check must be made payable to the account holder or joint account holder.

-

Yes. The check must be endorsed in the following manner: For mobile deposit only to SBTC, plus signature of payee.

-

No. Not all checks/items are eligible to be deposited through mobile check deposit. Per the user agreement, the following items are not eligible for deposit:

- Checks payable to any person or entity other than the person or entity that owns the account that the check is being

deposited into. - Checks containing an alteration on the front of the check or item, or which you know or suspect, or should know or

suspect, are fraudulent or otherwise not authorized by the owner of the account on which the check is drawn. - Checks payable jointly, unless deposited into an account in the name of all payees.

• Checks previously converted to a substitute check, as defined in Federal Reserve Board Regulation CC. - Checks drawn on a financial institution located outside the United States.

- Checks that are remotely created checks, as defined in Federal Reserve Board Regulation CC.

- Checks not payable in United States currency.

- Checks dated more than 6 months prior to the date of deposit.

- Checks or items prohibited by SBTC’s current procedures relating to the Services or which are otherwise not

acceptable under the terms of your SBTC account. - Checks payable on sight or payable through Drafts, as defined in Federal Reserve Board Regulation CC. Checks with

any endorsement on the back other than that specified in this agreement. - Checks that have previously been submitted through the Service or through an electronic deposit delivery system

offered at any other financial institution and/ or SBTC. (E.g. Mobile, Branch, ATM, Consumer, Merchant and

automated clearing house (ACH) check conversions.) - Checks or items that are drawn or otherwise issued by the U.S. Treasury Department

- Money Orders and Travelers Checks.

- Checks that are drawn on or produced from any of your SBTC account(s), written to yourself, and authorized by

yourself for deposit to your own account. - If an item is dishonored, you will receive an image of the original check or a substitute check as the chargeback item.

- Checks payable to any person or entity other than the person or entity that owns the account that the check is being

-

Checking (including Money Market & HSA) or Savings accounts that the user has setup to view through internet banking.

-

Yes. A clear image of both the front and back of the check must be taken and submitted. The system will reject an unclear image, or improper/missing endorsement and the customer will then have the option to take the picture again.

-

Yes. The customer must enter the dollar amount, the eligible account which they wish to deposit the check into, and a valid email address to receive their receipt of deposit

-

The customer will receive a “successfully submitted” message within their mobile app & a “deposit received” email alert upon successful transmission. The customer can also view the past 90 days of mobile deposit history by selecting the RECENT tab on the CHECK DEPOSIT page of the mobile app.

-

If a deposit is made before the cutoff time of 3:00pm CST, funds should be available the following business day (business days exclude Saturdays, Sundays, & federal holidays); however, extended holds may be placed on items at the sole discretion of SBTC.

-

The customer can see all of their transaction history 24/7 through internet/mobile banking. They will not receive a specific notification when the funds are available.