We all want to grow our business and maximize our earnings but oftentimes, we see both small businesses and medium-sized businesses missing small changes in their account structure that could add thousands to their bottom line every year. Moreover, a financial industry fascination with complex account structures and fee schedules creates more uncertainty and misplacement when onboarding new customers.

We all want to grow our business and maximize our earnings but oftentimes, we see both small businesses and medium-sized businesses missing small changes in their account structure that could add thousands to their bottom line every year. Moreover, a financial industry fascination with complex account structures and fee schedules creates more uncertainty and misplacement when onboarding new customers.

“Complexity is the enemy of execution.” Tony Robbins

We are commonly attracted to the complex but it also traps us from the efficiency of a simple structure. We’ve outlined three moves your business can make today to maximize your returns in your business checking.

1. Convert into a business checking account that pays interest

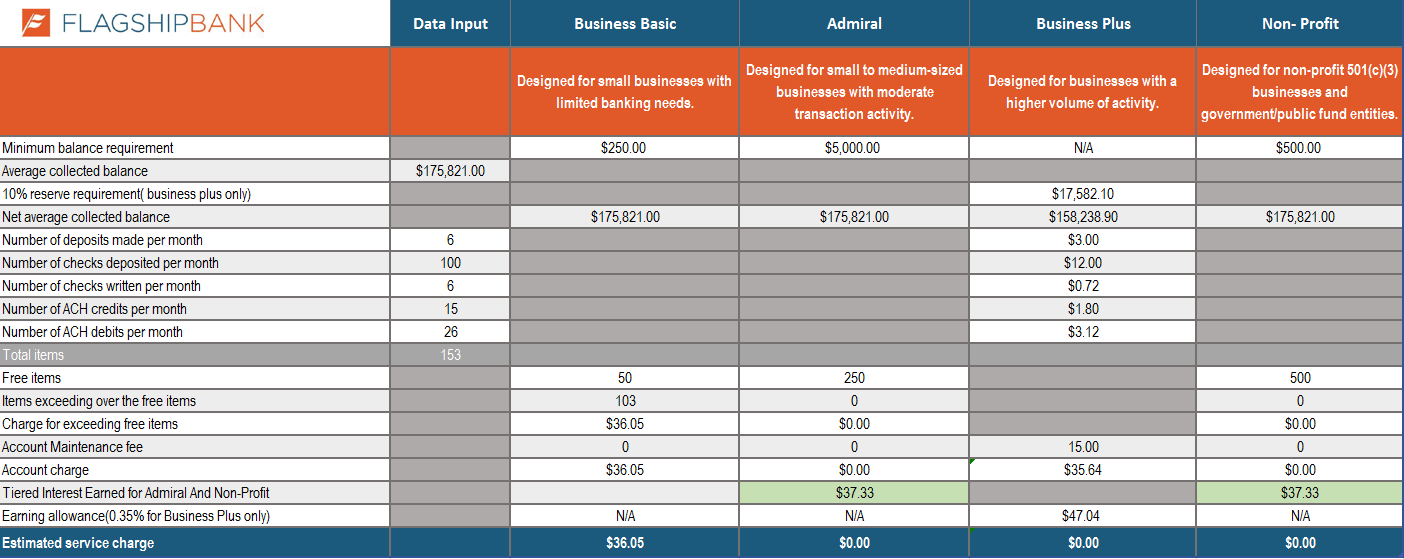

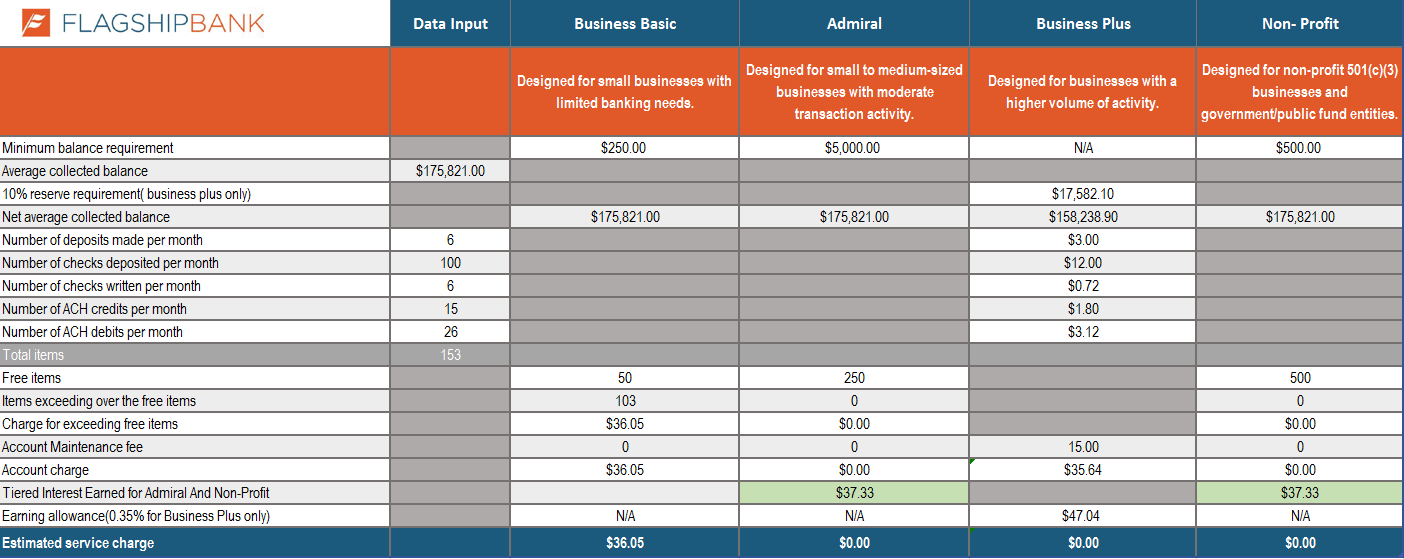

Your business may be better set for a business checking account that pays interest. In 2011, there was a regulation change that allows banks to pay interest on business checking accounts. Prior to the change, business checking accounts earned “earnings credits” which allowed for the reduction in fees but no earnings. This was a major shift and helps many businesses that keep great balances but don’t have tons of activity. Let’s review an example of an account with 153 items clearing and a $175,821 average balance:

*This grid is for example purposes only. More information can be found on our Business Accounts page or please talk to a banker today to get specific details, discuss your individual business’s needs, and for a comparison on your accounts.

As you can see from the comparison, moving into an Admiral Checking account, business checking with interest, would have increased monthly earnings by $37.33 vs a traditional Business Plus account.

In the traditional account, the earnings credit offset the activity but didn’t allow for any interest to be earned. Furthermore, the activity was not high enough to exceed the free items allowed by an interest checking account and even if it did, it would have required even more items to exceed the interest earned. This is low-hanging fruit with Flagship Bank Minnesota but in consideration of more complex products at other financial institutions, we have seen new customers see combined savings and increased earnings over $1,000 or more in a given year.

2. Sweep into a business money market account or against your line of credit

Small businesses often miss an opportunity to sweep excess funds into a money market/savings account or pay down a line of credit. To maximize the opportunity, the process starts with isolating how much depository funds are needed for everyday transaction activity. If this balance is $25,000, $50,000, or $100,000, set a target and then contact your banker to set up a sweep of the remaining funds to your business line of credit or into a money market account. Please keep in mind the six transactions monthly limit for withdrawal transactions on a money market account as the sweep can go both ways.

3. Use remote deposit to reduce travel time and to help manage your offices across a geographic area

Customers have mailed checks from office to office, to the bank, or scheduled regular branch visits to make deposits. Remote deposit capture (commonly referred to as RDC) allows your offices to scan check deposits in from their location to minimize delays and improve collection times.

Built for businesses with regular check collection activities, remote deposit has become increasingly common over the past few years. Here’s a short list of some of the many benefits of RDC:

- It has the flexibility to allow customers to print daily reports, organize detailed records of deposits, and make deposits when it’s flexible for your business.

- Eliminating the number of people handling the checks and streamlining the process also helps reduce the risk of fraud.

- How often have checks sat on your desk waiting for the next opportunity to make it to the bank? Scanning and depositing from your office reduces this lag time on important deposits so you can use the funds for operations or earn incremental interest.

- Our experience indicates that once a business is set up with RDC, they often find other everyday tasks that are eliminated or streamlined.

- Avoiding Minnesota winters! The roads in the winter can be difficult and the weather trying. Remote deposit capture allows you to enjoy the warmth of your office while making your regular deposit.

The move to remote deposit capture for your business is easy with the support of your local banker. The bank will provide the necessary software and hardware as well as the on-site training to get you up and running.

Summary: Small moves can save you money. If you are interested in learning more, check out our Guide to Cash Management.

We all want to grow our business and maximize our earnings but oftentimes, we see both small businesses and medium-sized businesses missing small changes in their account structure that could add thousands to their bottom line every year. Moreover, a financial industry fascination with complex account structures and fee schedules creates more uncertainty and misplacement when onboarding new customers.

We all want to grow our business and maximize our earnings but oftentimes, we see both small businesses and medium-sized businesses missing small changes in their account structure that could add thousands to their bottom line every year. Moreover, a financial industry fascination with complex account structures and fee schedules creates more uncertainty and misplacement when onboarding new customers.